70% of compliance professionals fear escalating menace of cryptocurrency-enabled money laundering

-

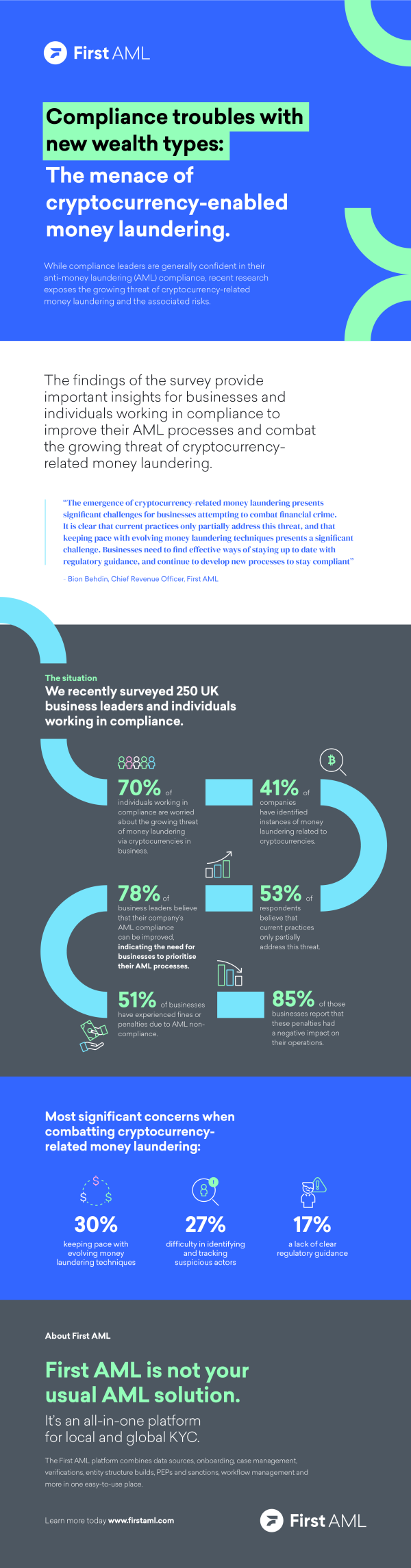

Nearly 70% of individuals working in compliance are worried about the growing threat of money laundering via cryptocurrencies in business.

-

More than half (53%) believe that current practices only partially address this threat.

Recent data uncovered by First AML has shed light on the growing threat of cryptocurrency-related money laundering. The survey, which gathered responses from 250 UK business leaders and individuals working in compliance, found that 70% of individuals working in compliance are worried about the growing threat of money laundering via cryptocurrencies in business.

The survey also revealed that a significant portion (41%) of companies have identified instances of money laundering related to cryptocurrencies, and more than half (53%) of respondents believe that current practices only partially address this threat. According to the data, keeping pace with evolving money laundering techniques (30%) is the most significant when combatting cryptocurrency-related money laundering.

AML improvements are needed

Furthermore, the survey found that a majority (78%) of business leaders believe that their company's AML compliance can be improved, indicating the need for businesses to prioritise their AML processes. Over half (51%) of businesses have experienced fines or penalties due to AML non-compliance, and a large majority (85%) of those businesses report that these penalties had a negative impact on their operations.

Additional challenges found in the survey include difficulty in identifying and tracking suspicious actors (27%) and a lack of clear regulatory guidance (17%). The findings of the survey provide important insights for businesses and individuals working in compliance to improve their AML processes and combat the growing threat of cryptocurrency-related money laundering.

Commenting on the survey, Bion Behdin, Chief Revenue Officer at First AML, said, "The emergence of cryptocurrency-related money laundering presents significant challenges for businesses attempting to combat financial crime. It is clear that current practices only partially address this threat, and that keeping pace with evolving money laundering techniques presents a significant challenge. Businesses need to find effective ways of staying up to date with regulatory guidance, and continue to develop new processes to stay compliant."

About First AML

First AML streamlines the entire anti-money laundering onboarding and compliance process. Backed by real expertise, its cloud-based KYC Passport allows complex entities to share their verification across multiple companies and geographies, at their discretion.

Making an otherwise complex and manual onboarding process simple for clients and cost effective and compliant for businesses, First AML delivers efficiency and time savings, protecting reputations, and enabling companies to be on the right side of history in the face of global threats.

Keen to find out more? Book a demo today! No time for a long demo? No problem. See what First AML can do for your business in 2 minutes – watch the short demo here.