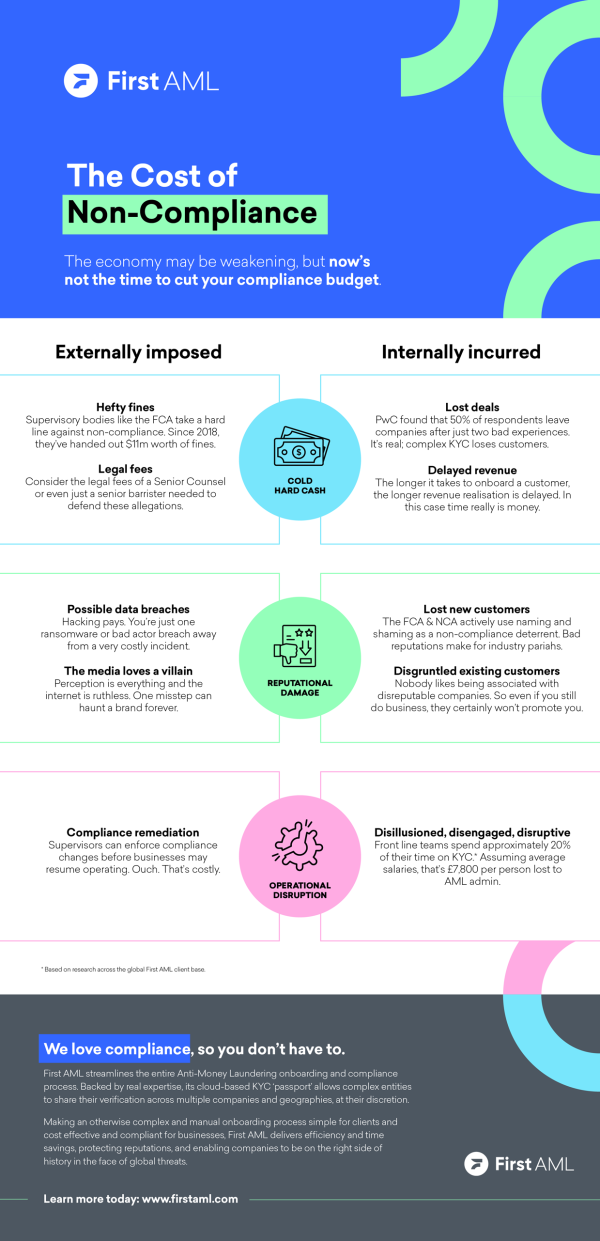

In today's economic climate, cutting costs may seem like the logical thing to do, but now's the not the time to cut your compliance budget.

Here are the three major consequences that come with non-compliance.

1. Monetary impact

Externally imposed

Hefty fines: Supervisory bodies like the Financial Conduct Authority (FCA) take a hard line against non-compliance. Since 2018, they've handed out $11m worth of fines.

Legal: Legal fees isn't cheap. Consider the legal fees of a Senior Counsel or even just a senior barrister needed to defend these allegations.

Internally incurred

Lost deals: PricewaterhouseCoopers found that 50% of respondents leave companies after just two bad experiences. It's real; a complex KYC onboarding process can lose you customers.

Delayed revenue: The sooner you onboard your customer, the quicker you start generating revenue. The longer it takes to onboard your customer, the longer revenue realisation is delayed. In this case, time really is money.

2. Reputational damage

Externally imposed

Possible data breaches: Hacking pays. You're just one ransomware or bad actor breach away from a very costly incident.

The media loves a villain: Perception is everything and the internet is ruthless. One misstep can haunt a brand forever.

Internally incurred

Lost new customers: The FCA and NCA actively use naming and shaming to discourage as a non-compliance deterrent. Bad reputations make for industry pariahs, and can lose you customers.

Disgruntled existing customers: Nobody likes being associated with disreputable companies. So even if you still do business, they certainly won't be telling others about you.

3. Operational disruption

Externally imposed

Compliance remediation: Supervisors can enforce compliance changes before businesses may resume operating. Any pause in business operations can impact revenue flow. Now, that's costly.

Internally incurred

Disillusioned, disengaged, disruptive: Frontline teams spend approximately 20% of their time on KYC. Assuming average salaries, that's $7800 per person lost to AML admin.

About First AML

First AML comes from the perspective of both a technology provider, but also as compliance professionals. Prior to releasing, First AML’s all-in-one AML workflow platform, we processed over 2,000,000 AML cases ourselves. Understanding the acute problem that faces firms these days as they try to scale their own AML, is in our DNA.

That's why First AML now powers thousands of compliance experts around the globe to reduce the time and cost burden of complex and international entity KYC. Source stands out as a leading solution for organisations with complex or international onboarding needs. It provides streamlined collaboration and ensures uniformity in all AML practices.

Keen to find out more? Book a demo today!