Tranche 2

What is Tranche 2 of the AML regime?

The Act currently targets the financial sector and other businesses that involve large transfers of cash – the gambling sector, remittance or money-transfer services, bullion dealers and more. A list of designated services – including taking deposits, payroll services and currency exchange – is included in the Act, and any business that provides one or more of these services must comply with the regulations. Some financial institutions are also required to report transactions over a certain threshold, along with any suspicious activity.

It’s looking increasingly likely that Tranche 2 of the Act will be implemented soon – so those who operate in the real estate, law, and accounting sectors need to start looking at how this will affect them too, and get their processes in place, ready to go.

Now that AML/CFT obligations are likely to apply to a broader range of organisations, more business owners will need to adjust their processes and put systems in place to ensure compliance. Adhering to the rules isn’t just a legal requirement, it’s also an important way to prevent criminal activity – and protect your business reputation.

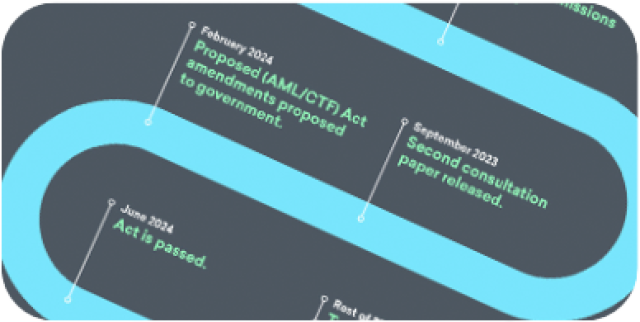

Expected AML/CTF Tranche 2 timeline

Here's the expected dates you should be aware of.

Whatcould Tranche 2 look like in Australia?

Businesses that are affected by the Act must register with AUSTRAC (Australian Transaction Records and Analysis Centre), the government agency responsible for deterring financial crime. Once your business is registered, you are a ‘reporting entity’ and need to keep up with your obligations under the Act.

This means:

- Developing a written AML/CTF program to manage compliance

- Carrying out risk assessments

- Appointing a compliance officer

- Collecting and verifying key client details before providing services – often referred to as ‘know your customer’ (KYC) information. This can mean taking verified copies of documents or using a credit-reporting body (CRB) to find and verify details.

- Reporting certain types of transaction – those over a certain monetary threshold, international transfers, information about carrying or shipping physical currency and any suspicious transactions or interactions

- Keeping and securely storing records showing your AML/CTF activity

- Submitting compliance reports if requested

- Paying an industry levy if your business earns over a certain threshold

How will Tranche 2 affect your business?

Real estate

Achieve compliance without commercial constraints. Learn how to be Tranche 2 compliant without risking transactions or customer relationships.

Law and Conveyancing

AML/CTF doesn't have to be difficult. Find out how it can be both on-chargeable and easy.

Accounting

Focus on advisory, not admin. When Tranche 2 hits, we'll help you meet your compliance requirements while protecting your bottom line and making KYC / KYB an easy process for your clients.