KYC for overseas clients

Support foreign direct investment or participation while protecting against PEP and sanction list inclusion.

Solve your toughest AML challenges with overseas clients.

Entity unwrap

Unwrap complex entity and ownership structures with a click.

With a single button press, visualise entities, UBOs, PSCs, and connections, even across multiple jurisdictions. Automatically retrieve and map verified shareholder data into your entity structures. Welcome to a new era of clarity and simplicity in KYB entity analysis.

Ongoing Monitoring

Always up-to-date and accurate.

Ongoing monitoring

Source by First AML delivers effortless ongoing monitoring, delivering auto alerts to fundamental changes like beneficial ownership or document expiry.

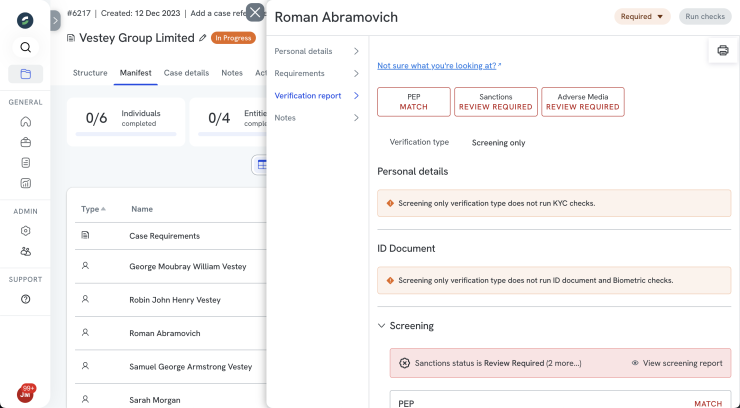

PEPs, sanctions and adverse media

Real-time monitoring of over 1,100 PEPs and Sanctions lists worldwide with results delivered via exception-based reports.

KYC for every investor type

Overseas clients are lucrative but inherently more risky. The First AML platform helps you address the unique needs for both individuals and business clients while delivering excellent onboarding experiences.

Onboarding overseas clients

Don't let foreign companies, tax haven domiciles or the physical absence of your client stop a deal. With First AML Source onboarding overseas clients is easy.

Publications for conducting KYC on overseas clients.

Tax havens: the good, the bad and the wealthy

For maximum tax efficiency, the wealthy create complex or opaque structures with multiple layers of ownership and shareholdings. This is great for them but bad for compliance. Find out how to manage this common wealth preservation tactic.

Navigating the complex world of sanctions

A comprehensive guide for politically exposed persons and businesses. This guide explores the intricacies of sanctions, including how they apply to PEPs, and the importance of conducting thorough PEP and sanctions checks.

Passporting: Not nearly as fun as it sounds for AML

Passporting is common practice that enables companies to serve clients across multiple jurisdictions. Here's why it's risky.

Legislative deep dive: Understanding high-risk countries in AML/CTF frameworks

Let's explore the legislative drivers surrounding high-risk countries, digging into their significance, how they're determined, and the implications for financial institutions and businesses worldwide.

8 common struggles with Source of Funds and Source of Wealth

Asking for Source of Funds (SoF) and Source of Wealth (SoW) information is a critical part of the AML process. But understanding the requirements and collecting the correct information is not easy. So here's a handy cheatsheet.