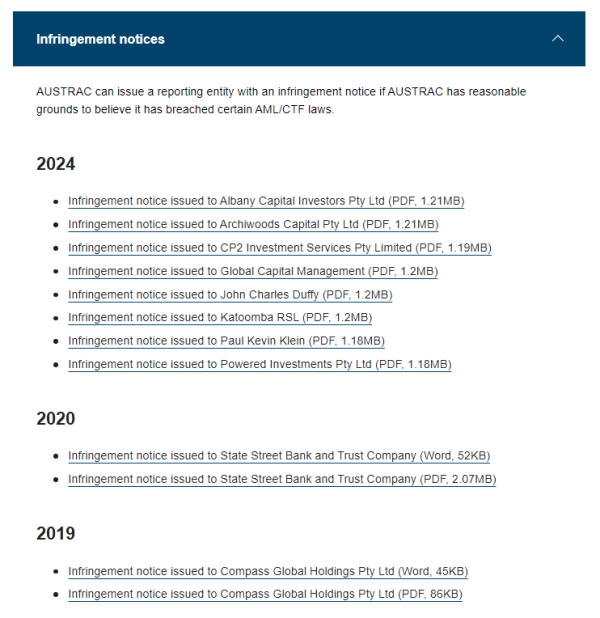

There have been immense developments in applying AI to AML over the past few years. As we're all aware, reporting entities face increasingly stringent AML obligations, and regulatory penalties for non-compliance are being handed out more frequently and with larger price tags. Take a look at AUSTRAC’s infringements this year versus any others.

Albany Capital didn’t file their report and have been hit with a $16,500 fine, even sole traders are being hit as John Charles Duffy found out when he was fined $3,300 also for not filing a report. These are just the small ones, SkyCity Adelaide has just agreed last month to pay $67m for AML breaches while enforceable actions are also ongoing for PayPal, Gold Corporation and others.

Whether it's conducting customer due diligence, transaction monitoring, or sanctions screening, compliance teams are struggling with complex, data-intensive processes that are prone to errors especially when handled manually.

Not to mention the pressure from customers themselves - they expect fast, easy digital onboarding no matter where they're located. Lengthy back or middle-office processes can directly impact a company’s ability to acquire and serve customers efficiently.

It's within this context that AI and machine learning have emerged as powerful tools to drive operational efficiencies while strengthening risk detection and mitigation capabilities.

Current AI/Machine Learning use cases

So now you know why this requirement is becoming increasingly more important for businesses, let’s look at some key areas where AI is already being used in the anti-money laundering space. Not surprisingly it’s being used to:

- Improve consistency and accuracy, especially at scale

- Streamline processes and improve efficiency for overstretched compliance teams

- Improve risk detection by using comparable technology that can fight sophisticated money laundering tactics

- Specifically, AI is currently being used in three key areas. First of all there is:

Transaction monitoring

Banks have been using forms of AI/ML since about 2019 to address the requirement of transaction monitoring. Traditional rules-based monitoring struggles with the vast data volumes and sophisticated transaction patterns involved in money laundering. AI and machine learning models are made for this type of data set and can more effectively analyse it, identify complex anomalies, prioritise genuine risks and flag to human users for closer inspection.

Biometrics and fraud

Customers are increasingly reluctant to go to a branch or office to prove they are who they say they are. So once again AI/ML has stepped in with biometric verification and anti-fraud document analysis. These solutions are now a standard commodity with providers locked in a war of ever increasing data points, trying to outpace each other to provide the highest pass rates with the least bias, across the most document types.

Sanctions screening

Finally we have sanctions compliance and the associated screening. There are now over 70,000 unique sanctioned persons globally, representing a 370% increase from when tracking began in 2017. Complexity is also on the increase due to differing rules in different jurisdictions.

The ability to reliably identify and take action on sanctioned individuals and entities is near impossible for humans but easy for AI/ML models.

In essence, AI/ML solutions are enabling more efficient and accurate compliance processes scaled for increasing data volumes - a true force multiplier for overstretched compliance teams.

Emerging trends & opportunities

While the current state is already transformative, we're just scratching the surface of AI's potential in this domain. Here are some of the emerging trends and innovations on the horizon:

Conversational AI and NLP

By leveraging natural language processing capabilities, AI can intelligently analyse vast pools of unstructured data like adverse media reports, complex legal documentation, and evolving regulatory guidance.

NLP-powered chatbots could even serve as educational aids, summarising compliance requirements on-demand to upskill analysts or act as a co-pilot as often touted in the software development field.

Reinforcement learning

One area of immense opportunity is reinforcement learning. AML compliance uses and creates immense amounts of data and insights. One idea that excites us here at First AML is this: imagine if an AI system could continually optimise itself by ingesting case outcomes and findings? It could dynamically adjust risk scoring parameters, due diligence triggers, data source weightings and more in a cycle of progressive self-improvement. Add to that a conversational AI and compliance teams would be a long way to automation.

Federated learning

Another area of significant opportunity to do the most good, is federated learning. Federated learning means taking a decentralised approach and allowing multiple institutions to collectively train AI models using their combined data, without compromising data privacy.

By pooling AML knowledge in a secure manner, the industry could develop more robust sector-wide intelligence and perhaps even lead to proactive compliance. This leads to our next point, predictive analytics.

Predictive analytics

Deep learning and neural networks open up possibilities for predictive models that can forecast emerging money laundering threats, typologies and patterns.

Rather than simply reacting to identified risks, we could start getting ahead of the curve through preventative strategies or even just enhanced due diligence measures.

Network analysis

By now you’re probably realising this is an interconnected web of opportunity. Future AI technologies could map and analyse the interconnected networks of transactions, entities and UBOs to detect hidden patterns potentially indicative of money laundering that may go undetected with traditional methods.

This is already happening in the cyber security space where software platforms, such as CrowdStrike, use trillions of events and intelligence results from across their customer base to train their AI systems. This then feeds back to the system that deploys new detections on their customers’ behalf.

Intelligent process automation

Finally we have intelligent process automation. From document ingestion to intelligent onboarding flows, decisioning to regulatory reporting, AI-driven process automation will be able to do many of the scrolls, clicks and collation that takes so much time now for compliance teams and with much fewer errors.

These are just some of the interesting applications being explored and developed. The possibilities for AI to fundamentally improve our compliance capabilities are vast.

Challenges & considerations

The future of AI and AML looks promising, but as impressive as these technologies may be, they do present very real challenges and risks that should be considered.

Ethical implications

Given compliance handles so much personally identifiable information, or PII, stringent governance is critical to ensure AI solutions are developed and deployed in alignment with ethical principles around transparency, accountability, privacy and anti-bias.

Data privacy and security

Any AI/ML solution will be ingesting and processing highly sensitive data. We have an obligation to implement rigorous data protection and security protocols to safeguard this information and maintain public confidence.

Mitigating bias and discrimination

Like any model, AI runs the risk of exacerbating biases in data and training methods which could result in discriminatory outcomes. Detecting, monitoring and mitigating bias must also be considered when considering AI and AML.

These are all big problems that the AI field in general is facing. But by addressing them head-on and considering their impact from the outset, I'm confident we can fully realise AI's positive potential in the AML compliance function.

Conclusion

Innovating with AI is not just about operational efficiency or jumping on the AI bandwagon. At First AML, we truly believe it’s about futureproofing our financial system's integrity against threats from criminals who will try any means possible to get away with the proceeds of their crimes.

About First AML

First AML simplifies the entire anti-money laundering onboarding and compliance process. Its SaaS platform, Source, stands out as a leading solution for organisations with complex or international onboarding needs. It provides streamlined collaboration and ensures uniformity in all AML practices.

First AML transforms an otherwise complex and manual process into one that is simple, cost-effective, and compliant for businesses. By delivering efficiency and time savings, it protects reputations and enables companies to stay on the right side of history in the face of global threats.

Keen to find out more? Book a demo today! No time for a long demo? No problem. See what Source by First AML can do for your business in 2 minutes – watch the short demo here.